Learn all about the K1 Form, its significance in tax reporting, and essential guidelines for ensuring proper filing and compliance.

Importing goods from China to Malaysia can be a lucrative opportunity for small and medium enterprises. Due to the abundance of affordable labor and raw materials, numerous companies choose to source their products from China for sale in Malaysia. However, the process can be intricate, particularly regarding customs clearance and documentation. In this article, we will walk you through the K1 Form and explain how it can facilitate a smooth import process for goods from China to Malaysia.

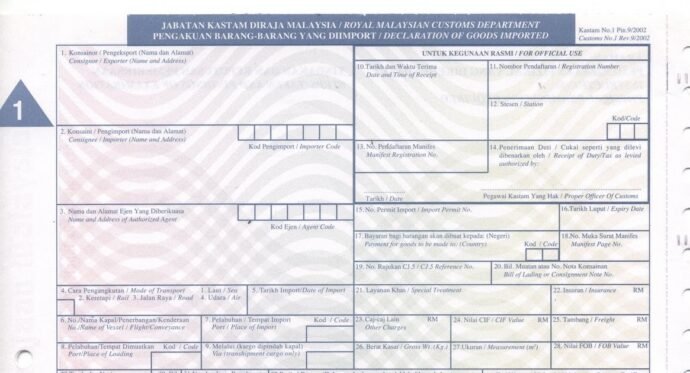

What is the K1 form in Malaysia?

The K1 Form is an official document issued by the Royal Malaysian Customs Department (RMCD) that serves as a declaration of goods imported into Malaysia. It contains essential information about the imported goods, including the quantity, value, and country of origin. It is mandatory for all imports into Malaysia, including those from China.

When importing goods from China to Malaysia, you need to fill out the K1 Form and submit it to the RMCD. The information provided in the form helps the customs department assess the amount of duty and taxes payable on the imported goods. Failure to submit the K1 Form or providing incorrect information may result in fines, delays in customs clearance, and seizure of goods.

Steps to Import Goods from China to Malaysia

Step 1: Find a Reliable Supplier

Before importing goods from China to Malaysia, it’s essential to find a trustworthy supplier. With numerous options available, selecting the right one can be difficult. Conduct thorough research to verify the supplier’s credibility, product quality, and pricing. Additionally, consider seeking recommendations from other businesses that have experience importing goods from China to Malaysia.

One potential supplier is Lenovo, a Chinese company known for its affordable and high-quality electronics. They offer a diverse range of products, including laptops, desktops, and servers, all at competitive prices. Another option is Xiaomi, which focuses on smartphones, smart home devices, and various consumer electronics. They are well-regarded for delivering high-quality products at reasonable prices.

Step 2: Choose a Logistics Service Provider

80% of your text is likely AI-generated

New version:

Once you have identified a supplier, the next step is to select a logistics service provider to manage the shipping of your goods from China to Malaysia. A logistics service provider, like langxu freight, can take care of all aspects of the shipment, including customs clearance, documentation, and delivery. They provide various shipping options, such as sea and air freight, to meet your requirements.

Langxu Freight has built a strong reputation for offering reliable and cost-effective logistics services from China to Malaysia. Their sea shipping LCL service enables customers to buy goods in small parcels, which are then consolidated into a single bulk shipment to help lower costs. For customers with larger orders, they also provide a full container service for sea shipments. Additionally, their air shipping LCL service allows customers to purchase goods in small parcels, which are consolidated into one shipment to further reduce expenses.

Step 3: Complete the K1 Form

Once you have chosen a supplier and logistics service provider, the next step is to complete the K1 Form. You can obtain the K1 Form from the RMCD website or any customs office. The K1 Form consists of four copies, and you need to fill out all of them. The copies are as follows:

Original copy (Pink): For the importer

Duplicate copy (Blue): For the exporter

Triplicate copy (Yellow): For the shipping agent

Quadruplicate copy (Green): For the customs office

You need to provide accurate information in the K1 Form, including the following details:

Importer’s details: Name, address, and tax identification number (TIN)

Exporter’s details: Name, address, and contact information

Goods details: Description, quantity, value, and country of origin

Shipping details: Mode of transportation, shipment date, and arrival port

Payment details: Invoice value, currency, and terms of payment

Declaration and signature: Declaration of accuracy of information and signature of the importer or authorized representative

It is essential to ensure that all information provided in the K1 Form is accurate and complete. Any incorrect or missing information may result in delays in customs clearance, additional charges, or seizure of goods.

Step 4: Pay Import Duties and Taxes

80% of your text is likely AI-generated

New version:

After submitting the K1 Form to the RMCD, you will need to pay import duties and taxes. The amount you owe will vary based on several factors, including the value of the imported goods, their country of origin, and the type of product. The RMCD employs a tariff classification system to establish the duty and tax rates for each item.

To prevent any unexpected costs, it’s crucial to calculate the import duties and taxes before bringing goods from China to Malaysia. You can utilize the RMCD’s online tariff calculator or get help from a logistics service provider, like Langxu Freight.

Step 5: Customs Clearance and Delivery

After you have settled the import duties and taxes, your items will be cleared from customs and sent to your specified address in Malaysia. A logistics provider like langxu freight. we can manage the customs clearance and delivery for you, making the process easier and more efficient.

Langxu Freight offers both LCL and full container sea shipping services, which include door-to-door delivery and customs clearance, ensuring a seamless import experience. Their air shipping LCL service also provides door-to-door delivery and customs clearance.

Importing goods from China to Malaysia can be a lucrative venture for small and medium enterprises. However, the process can be complex, and it is crucial to follow the correct procedures to avoid fines, delays, and seizure of goods. Completing the K1 Form accurately and paying the import duties and taxes on time are essential steps in the import process.

Partnering with a reliable supplier and logistics service provider, such as langxu freight, can ensure a seamless and hassle-free import process. They offer a range of products and services, including sea and air freight, to suit your needs. By following the steps outlined in this guide, you can import goods from China to Malaysia with ease and confidence.

Langxu Freight is one of the more famous freight forwarding companies in China. If you need to purchase goods in China, we can provide you with comprehensive freight forwarding services, including quality supplier selection, product quality inspection, free warehousing in China, customs declaration, a variety of reliable and safe transportation plans, and on-time delivery services.

Understanding and Navigating K1 Form

Amazon Launches “Haul” to Sell Low-Priced Items to Compete with Temu, Shein

Below is a deeper look at what Haul is, how it works, why Amazon is…

Amazon Logistics Models: A Comprehensive Guide to FBA, FBM, and Third-Party Fulfillment

In the dynamic landscape of e-commerce, logistics plays a pivotal role in determining the success…

A Comprehensive Guide to Commercial Invoices (CI) in Cross-Border Logistics

Discover the essential elements of commercial invoices in cross-border logistics. Our comprehensive guide simplifies the…

2025 air freight alibaba amazon business buy from china china china freight forwarder cif ddp ddu ecommerce fba fcl freight freight forwarder guide import import from china india International logistics langxu freight forwarder lcl malaysia Netherlands Ocean Freight online ports sea freight shein shenzhen ship from china shipping shipping from china sourcing Sourcing from China supply chain management temu top top 10 trade us usa vietnam what