Understanding and Navigating K1 Form: A Guide for International Businesses. In the intricate landscape of international trade, understanding and complying with customs regulations is paramount for smooth and efficient operations. For businesses importing goods into Malaysia, the K1 Form stands as a critical document that simplifies the customs clearance process. This article aims to provide a comprehensive understanding of the K1 Form, its importance, and how to navigate its requirements effectively. Additionally, we will introduce the services of langxu freight, an international logistics and procurement specialist with extensive experience in assisting businesses with their Malaysian import needs.

1. Introduction to Malaysia’s K1 Form

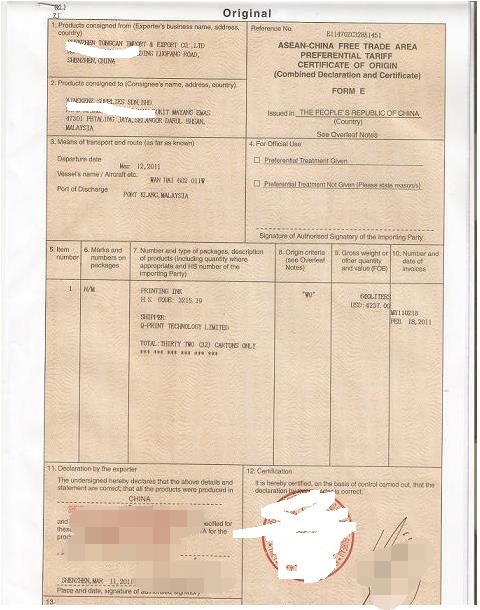

The K1 Form, also known as the Customs Declaration Form, is a document required by the Royal Malaysian Customs Department (RMCD) for all imports into Malaysia. It serves as a declaration of the goods being imported, detailing their description, quantity, value, and other pertinent information necessary for customs assessment and clearance.

2. The Importance of the K1 Form

2.1 Facilitating Customs Clearance

The K1 Form is the cornerstone of the customs clearance process in Malaysia. It provides customs officials with the necessary information to assess duties, taxes, and any other charges applicable to the imported goods. Without a properly completed K1 Form, goods may be delayed or even rejected at the border, leading to additional costs and potential disruptions in the supply chain.

2.2 Ensuring Compliance

Compliance with customs regulations is crucial to avoid penalties, fines, and potential legal issues. The K1 Form ensures that importers declare their goods accurately and completely, adhering to Malaysian customs laws and regulations.

2.3 Enabling Trade Facilitation

An efficient and transparent customs clearance process fosters trade facilitation, encouraging international business and investment. The K1 Form plays a vital role in this process, facilitating the smooth flow of goods into Malaysia.

3. Key Elements of the K1 Form

The K1 Form consists of several sections that must be completed accurately and thoroughly. The following are some of the key elements:

- Importer Information: Details of the importer, including name, address, and contact information.

- Exporter Information: Details of the exporter, including name, address, and country of origin.

- Goods Description: A detailed description of the goods being imported, including their quantity, weight, and value.

- HS Code: The Harmonized System (HS) code for each item, which classifies goods for customs purposes.

- Customs Value: The value of the goods for customs assessment, typically based on the transaction price.

- Origin of Goods: The country where the goods were produced or manufactured.

- Licenses and Permits: Any required licenses or permits for the import of specific goods.

4. Steps to Complete the K1 Form

4.1 Gather Information

Before starting the K1 Form, gather all necessary information about the import, including invoices, packing lists, and any other relevant documents.

4.2 Access the Form

The K1 Form can be obtained from the RMCD’s official website or through customs agents and freight forwarders like langxu freight.

4.3 Fill in the Details

Complete each section of the form accurately, ensuring all information is consistent with the accompanying documents.

4.4 Review and Verify

Double-check all entries for accuracy and completeness. Errors or omissions can lead to delays or rejection of the goods.

4.5 Submit the Form

Submit the completed K1 Form to the RMCD, either electronically through the customs’ online system or in hard copy at the port of entry.

Insert Company Mention:

At langxu freight, we offer comprehensive customs clearance services, including assistance with completing and submitting the K1 Form. Our experienced team ensures that all documentation is accurate and compliant, minimizing the risk of delays or rejections.

5. Common Challenges and How to Overcome Them

5.1 Incorrect HS Codes

Assigning the wrong HS code can lead to incorrect duty assessments and potential penalties. Research the correct HS code for each item or consult with a customs expert like langxu freight.

5.2 Valuation Issues

Determining the customs value can be complex, especially for goods with multiple components or intangible values. Use the transaction price as a basis and consult customs regulations for specific valuation methods.

5.3 Documentation Errors

Incomplete or incorrect documentation is a common cause of delays. Ensure all required documents are included and match the information on the K1 Form.

Insert Company Mention:

langxu freight provides a thorough document review service to identify and rectify any potential issues before submission, ensuring a smooth customs clearance process.

6. Benefits of Using a Professional Logistics Provider

Navigating the complexities of the K1 Form and customs clearance can be daunting for international businesses. Partnering with a professional logistics provider like langxu freight offers several benefits:

- Expertise and Experience: Our team has extensive experience in handling Malaysian customs procedures, ensuring compliance and efficiency.

- Time and Cost Savings: We streamline the process, reducing the risk of delays and minimizing costs associated with customs errors.

- Customized Solutions: We tailor our services to your specific needs, offering flexibility and personalized support.

- End-to-End Service: From procurement in China to delivery in Malaysia, we handle every aspect of the supply chain, ensuring a seamless experience.

7. Additional Considerations for Importing into Malaysia

7.1 Import Licenses and Permits

Certain goods may require import licenses or permits. Check the RMCD’s guidelines to determine if your goods are subject to these requirements.

7.2 Duty and Tax Calculations

Understand the duty and tax rates applicable to your goods. Malaysia’s customs duty rates vary depending on the type of goods and their origin.

7.3 Customs Bonding and Warehousing

For goods that require further processing or storage before distribution, consider customs bonding and warehousing options.

Insert Company Mention:

langxu freight offers customs bonding and warehousing services, providing a secure and efficient solution for your imported goods.

8. Staying Informed and Adapting to Changes

Customs regulations and procedures are subject to change. Stay informed by regularly checking the RMCD’s updates and announcements. Adapting to these changes promptly can help avoid disruptions in your supply chain.

Conclusion

The K1 Form is a fundamental aspect of importing goods into Malaysia, playing a crucial role in customs clearance and compliance. By understanding its requirements and following the steps outlined in this guide, international businesses can navigate the process with confidence. Partnering with a professional logistics provider like langxu freight can further enhance your importing experience, offering expertise, efficiency, and customized solutions to meet your unique needs.

As you embark on your importing journey to Malaysia, let langxu freight be your trusted partner. With our deep knowledge of Malaysian customs procedures, extensive experience in international logistics, and commitment to excellence, we’re here to support you every step of the way, ensuring a smooth and successful import process.

K1 Form everything you should know

Amazon Launches “Haul” to Sell Low-Priced Items to Compete with Temu, Shein

Below is a deeper look at what Haul is, how it works, why Amazon is…

Amazon Logistics Models: A Comprehensive Guide to FBA, FBM, and Third-Party Fulfillment

In the dynamic landscape of e-commerce, logistics plays a pivotal role in determining the success…

A Comprehensive Guide to Commercial Invoices (CI) in Cross-Border Logistics

Discover the essential elements of commercial invoices in cross-border logistics. Our comprehensive guide simplifies the…

2025 air freight alibaba amazon business buy from china china china freight forwarder cif ddp ddu ecommerce fba fcl freight freight forwarder guide import import from china india International logistics langxu freight forwarder lcl malaysia Netherlands Ocean Freight online ports sea freight shein shenzhen ship from china shipping shipping from china sourcing Sourcing from China supply chain management temu top top 10 trade us usa vietnam what