Explore the latest trends in cross-border e-commerce as we transition from holiday highs to everyday realities. Stay ahead in the evolving market landscape.

Introduction: A Changed Holiday Season

The holiday season, once a predictable peak for online retailers, is unfolding differently this year. In years past, mid-to-late December brought a sales surge as shoppers rushed to finish their Christmas gift buying. However, 2024 has seen an unexpected twist: instead of a late-season rush, sales began dropping off early, catching many sellers off guard. Social media comments from sellers illustrate the stark contrast – one Amazon seller lamented that in previous years December 18–20 was the final peak of the year, but this year order volume started plummeting before December 20 and continued to fall into a slump by December 22.

Another seller reported that sales on December 20 were only half of what they were just a day earlier, and that after December 15 orders fell to just 30% of normal levels. This phenomenon, where the traditional holiday rush turns into an early-season lull, is not an isolated incident but a widespread trend this year, raising concerns about inventory overstock and high storage fees. In this post, we’ll explore the factors behind this early decline in orders, how consumer behavior is shifting, and what strategies sellers can adopt to navigate these changing cross-border e-commerce trends.

The Early Holiday Slowdown: What Happened to Orders?

Several factors have contributed to the unusual early decline in holiday sales this year. One key factor is the impact of inflation and high interest rates on consumer spending. In major markets like the United States, prices remain elevated compared to a few years ago, and borrowing costs have risen. This economic environment has made many households tighten their budgets and prioritize essential purchases over discretionary ones.

As a result, consumers are more cautious with their spending, especially on non-essential holiday gifts. Instead of splurging on high-priced presents, many shoppers are either scaling back gift lists or opting for more practical gifts (or even no gifts at all) and choosing lower-cost alternatives. This shift in sentiment has directly translated into fewer last-minute holiday shopping trips online.

Another contributing factor is the changing timing of consumer purchases. In recent years, improved logistics and the prevalence of early-season discounts have led many shoppers to spread out their holiday spending. Events like Black Friday and Cyber Monday have grown in importance, with consumers doing a large portion of their gift-buying during those November sales rather than waiting until December. In other words, many shoppers essentially front-loaded their holiday spending during the Black Friday/Cyber Monday period, leaving little pent-up demand for a late-December rush.

This trend of earlier purchasing was evident in the data: for example, Salesforce reported that in the 45 days from November 1 to December 15, U.S. online sales had already increased by 4% year-over-year to $238 billion, and global online sales rose 7% to $1.033 trillion during the same period. In other words, a significant portion of holiday shopping had already been completed well before the final weeks of December. The net effect is that the traditional spike in orders right before Christmas has flattened out, as consumers spread their purchases over a longer window.

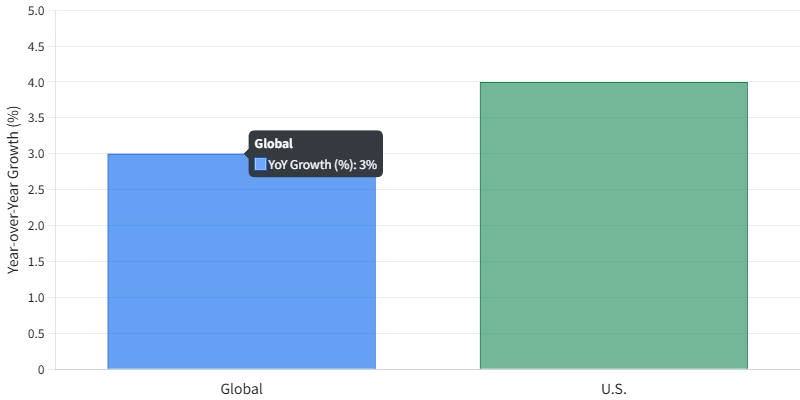

Comparison of Global vs. U.S. Online Sales Growth (Nov 1 – Dec 15)

Global Consumer Trends: Caution Amidst Growth

While many sellers experienced an early sales drop, it’s important to note that the global e-commerce landscape is not collapsing – in fact, online spending is still growing, just in a more distributed and cautious manner. The Salesforce data mentioned above shows that holiday online sales did hit record levels when aggregated over the entire season. Globally, shoppers spent about $1.2 trillion online in the 2024 holiday season (November through December), up 3% from the previous year, and in the U.S. online holiday spending reached approximately $282 billion, a 4% increase.

These figures indicate that overall consumer demand for online shopping remains strong, but the pattern of demand is changing. Instead of a short burst of intense buying in late December, shopping has become more spread out throughout the holiday period and even into the new year. This shift has been driven by several trends:

- Price Sensitivity and Smart Shopping: Consumers have become extremely price-conscious in the current economic climate. Inflation has made everyday essentials more expensive, so shoppers are carefully budgeting and seeking the best deals. According to recent consumer surveys, price is the top factor influencing purchase decisions – well ahead of other considerations like brand loyalty. In the U.S., 79% of shoppers say they compare prices before making a purchase, and 69% do so frequently. This has led to a “wait-and-see” approach where many consumers held off on buying until discounts became available, rather than purchasing early or late in the season. When discounts did occur (for example, during Black Friday or Cyber Monday), shoppers were quick to take advantage of them. Retail data shows that even though average discounts weren’t as deep this year as in some past years, the responsiveness of consumers to discounts was strong – every 1% drop in price spurred about a 1.03% increase in demand, translating into billions of extra dollars in online sales. The net result is that while total holiday spending is up, it’s being pulled into deal periods rather than happening uniformly across the season.

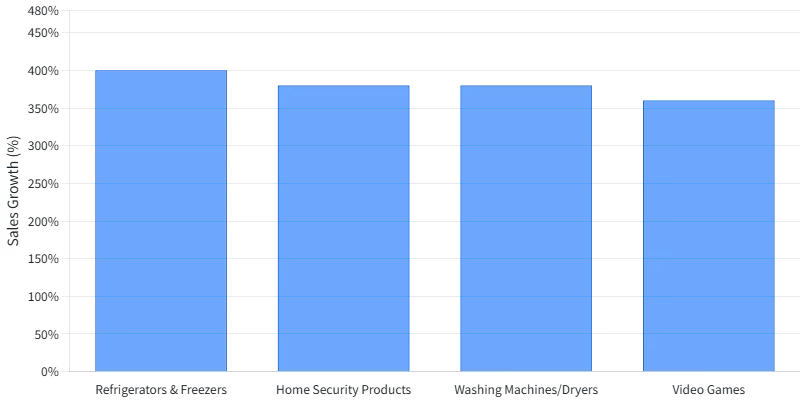

- Shift to Practical and Value Purchases: Economic pressures have also influenced what people are buying. There is a noticeable trend of consumers prioritizing practical, high-value items over luxury or purely discretionary goods. Big-ticket purchases that households have been planning – such as home appliances, electronics, or home improvement products – are seeing strong demand, because shoppers view these as investments and are willing to spend on them when the price is right. For example, sales of refrigerators and freezers soared by about 400% during the holiday season, home security products by 380%, and washing machines/dryers by 380%. Even gaming consoles and video games saw big jumps (360% and 330% respectively). These are purchases that might have been deferred earlier in the year, but with discounts available and the desire to upgrade homes or entertainment setups, consumers pulled the trigger during holiday sales. At the same time, sales of traditional holiday gift categories like apparel and toys grew more modestly or even saw declines in certain segments. In short, consumers are focusing on needs and value, buying what they truly need or have been planning to buy, and are less inclined to splurge on extra items just for the sake of gifting. This is a shift from the “spending for spending’s sake” mindset that often drives late-season gift buying.

Holiday Sales Growth for Select Product Categories

- Informed and Prolonged Shopping Journeys: Today’s online shoppers are also more informed and deliberate in their purchases. They spend more time researching products, reading reviews, and comparing options before pulling the trigger. In fact, Salesforce noted that consumers are “spending more time shopping online and using AI tools to research products.” This trend has contributed to the spread of shopping over a longer period – instead of making impulse buys in late December, many consumers started their holiday shopping research early (some even before Thanksgiving) and then executed purchases in stages as they found the right deals. The use of AI-powered shopping assistants and chatbots has skyrocketed (a 1,300% increase in traffic from AI chatbots to retail sites, for example), indicating that shoppers are actively using technology to find information and deals. Additionally, the rise of social commerce (buying directly through social media platforms) has changed when and how purchases are made. TikTok Shop, Instagram Shopping, and similar channels saw significant engagement this holiday season – about 20% of global holiday sales were made through social commerce platforms. These platforms often feature flash sales or influencer-driven promotions that occur at various times, not necessarily aligning with the traditional late-December rush. All these factors mean that the online shopping journey is now more fragmented and prolonged, rather than a last-minute frenzy.

- Year-Round E-Commerce Maturity: E-commerce itself has matured to the point where it’s no longer a novelty centered around big holiday events. Over the past few years, especially post-pandemic, online shopping has become an everyday habit for consumers. The days of a single peak in December are fading as shopping becomes a year-round, always-on activity. In fact, analysts suggest that e-commerce penetration in many markets is approaching a saturation point – meaning most consumers who are going to shop online are already doing so regularly. The seasonal spikes are becoming less pronounced because a baseline of online shopping exists throughout the year. For example, online grocery shopping, once a holiday-driven category, has grown in popularity and is now a routine for many. Similarly, categories like health and beauty products or pet supplies are seeing consistent online demand. In practical terms, this means that while the holiday season still matters, it’s no longer the sole driver of e-commerce growth. Consumers are spreading their shopping across the year, and even during the holidays, they are making purchases in a more staggered way. This shift toward a “year-round, fragmented” shopping pattern has been observed industry-wide. As one report noted, the traditional model of a concentrated holiday sales explosion is evolving into a pattern of steady, ongoing online buying with smaller peaks around promotions. This maturation of e-commerce is good for the long-term health of the industry, but it requires sellers to adjust their expectations and strategies accordingly.

Adapting Strategies for Sellers and Brands

Given these changes, cross-border e-commerce sellers (and the brands behind them) must adapt their strategies to remain successful. The old playbook of relying on a single late-December surge is no longer sufficient. Here are several key strategies to consider in this new environment:

- Adjust Your Timing and Promotions: One immediate adjustment is to rethink the timing of sales and promotions. Instead of going all-in on late-season deals, sellers should consider running strategic promotions throughout the holiday period and even into the new year. For example, many consumers will continue shopping right after Christmas (to take advantage of clearance sales or to buy gifts they couldn’t find earlier). Offering “post-holiday” promotions or New Year sales can capture this lingering demand. It’s also wise to start holiday promotions a bit earlier to align with the Black Friday/Cyber Monday trend when many shoppers are already active. This doesn’t mean you should abandon late December entirely – there will still be some last-minute shoppers – but it’s important not to over-invest in late-season inventory or ads expecting a big surge that may not come. Diversifying promotion timing can help smooth out order flow and reduce the risk of overstock.

- Pivot Product Mix to Essentials and High-Demand Items: In light of the consumer focus on practical goods, sellers should ensure their product offerings align with what buyers are actually looking for. This might mean shifting emphasis away from purely seasonal or novelty items and toward everyday essentials and high-demand products. For instance, if you sell home goods, focus on kitchen gadgets, bedding, or storage solutions (categories that saw strong sales this year). If you’re in electronics, highlight practical devices like tablets, laptops, or home office equipment that people need. Even if your core business is in something like fashion or toys, consider offering bundles or value packs that feel like a good deal. The idea is to meet customers where their needs are – in this case, practical, value-oriented purchases. That said, it’s important not to completely abandon your niche. Instead, think about how to position your products as meeting a real need or desire in this climate. For example, if you sell holiday decor, you might promote post-holiday storage solutions for those decorations, turning a seasonal item into a practical purchase. Flexibility in product strategy will be crucial.

- Embrace Agile Supply Chain and Inventory Management: The early sales drop and the risk of inventory overstock highlight the need for an agile supply chain. Sellers should be prepared to quickly adjust inventory orders and allocations based on real-time sales data. In practical terms, this means not overcommitting to inventory well in advance of the holidays and having the ability to restock fast if certain products start selling. Many sellers have learned the hard way this year that carrying too much holiday stock too early can lead to storage problems and high fees if sales don’t materialize as expected. To avoid this, consider a just-in-time inventory approach or using drop-shipping and third-party logistics that can scale up or down quickly. It’s also wise to clear out any excess holiday inventory soon after the season – run clearance sales, bundle slow movers, or even liquidate if necessary – to free up cash flow and avoid tying up capital in unsold goods. In the long run, building a supply chain that can adapt to changing demand (for example, by diversifying suppliers or using air freight for speed during peak periods) will pay off in a market where demand is less predictable.

- Focus on Marketing for Value and Practicality: Marketing messages should also evolve to reflect the consumer mindset. This year, emphasize value, utility, and necessity in your marketing rather than just festive hype. For example, if you’re promoting a product, highlight how it solves a problem or meets a need in the customer’s life. Use messaging that reassures customers they are making a smart purchase (e.g., by showcasing the product’s durability, multi-functionality, or how it can save money in the long run). Product reviews and social proof are critical now – consumers are doing more research, so provide them with helpful content (detailed product descriptions, comparison guides, user reviews) to support their decision-making. If you have a brick-and-mortar presence or omnichannel strategy, leverage that as well; many consumers still appreciate the ability to see or try products in person (even if they end up buying online for convenience). In short, tailor your marketing to speak to the rational, research-driven shopper of 2024, not just the impulse buyer of Christmases past.

- Leverage New Technologies and Channels: Finally, stay abreast of the tools and channels that consumers are using. The rise of AI in shopping is not just a novelty – it’s a trend that can be harnessed. Consider implementing AI-driven personalization on your site (such as product recommendations or chatbots that assist customers) to enhance the shopping experience. As we saw, a significant portion of online sales (19% globally this holiday season) were influenced by AI in some way, whether through personalized recommendations or customer service interactions. Making use of these tools can help improve conversion rates and customer satisfaction. Additionally, don’t ignore social commerce. If you have products that can benefit from visual appeal or influencer endorsements, explore selling on platforms like Instagram or TikTok. Even if you don’t sell directly on those platforms, maintain an active social media presence to engage with customers and drive traffic to your site. By meeting customers on their preferred platforms (whether that’s Amazon, your own site, or social media), you can capture sales whenever the buying mood strikes them, rather than waiting for a specific date.

Conclusion: Embracing a New Normal in E-Commerce

The 2024 holiday season has sent a clear message to the e-commerce world: the old playbook of late-season sales spikes is no longer the sure bet it once was. Cross-border sellers faced a sobering reality when orders started declining weeks before Christmas, highlighting the need to adapt to changing consumer behaviors and market conditions. High inflation, cautious spending, and the spread of shopping throughout the year are reshaping the retail landscape.

However, it’s not all doom and gloom – online spending is still growing, and consumers are very much active shoppers, just in a more informed, value-driven way. For sellers, this means evolving from a mindset of “wait for the holidays” to one of continuous engagement with customers. By adjusting strategies to meet shoppers where they are – offering the right products at the right time with the right value proposition – businesses can thrive in this new environment.

The future of e-commerce will belong to those who can build agile, data-driven operations and who understand that the holiday season is now just one part of a longer, more complex shopping journey. Embracing these changes and learning from the trends of 2024 will help ensure a prosperous new year for cross-border sellers and brands alike.

Amazon Launches “Haul” to Sell Low-Priced Items to Compete with Temu, Shein

Below is a deeper look at what Haul is, how it works, why Amazon is…

Amazon Logistics Models: A Comprehensive Guide to FBA, FBM, and Third-Party Fulfillment

In the dynamic landscape of e-commerce, logistics plays a pivotal role in determining the success…

A Comprehensive Guide to Commercial Invoices (CI) in Cross-Border Logistics

Discover the essential elements of commercial invoices in cross-border logistics. Our comprehensive guide simplifies the…