Uncover the impact of Jiangsu’s 30 industrial belts on China’s booming cross-border e-commerce. Learn about the key players and trends transforming the market.

Introduction

In the vast landscape of China’s e-commerce boom, Jiangsu Province has emerged as a powerhouse of cross-border online trade. Known for its robust industrial base, Jiangsu is harnessing its manufacturing clusters – known as industrial belts – to drive a new wave of export growth. This blog post will explore Jiangsu’s 30 industrial belts, their key product offerings, and the unique advantages that position them at the forefront of China’s cross-border e-commerce revolution. We will also examine the strategies these belts are adopting to thrive in global markets and the opportunities and challenges they face in this dynamic environment.

Overview of Jiangsu’s Industrial Belts

Jiangsu, a province in eastern China, is one of the country’s most economically developed regions. It is home to over 60 distinct industrial belts across its 13 prefecture-level cities. These belts are specialized manufacturing clusters, each focused on a particular industry or product category. Rather than competing on generic goods, Jiangsu’s manufacturers have carved out niches in high-value and niche segments, creating a breadth and depth of product supply that is unparalleled in many other regions. This diversity is a cornerstone of Jiangsu’s success in cross-border e-commerce. Sellers and platforms alike recognize that industrial belts mean reliable sourcing and product variety – the backbone of any successful export strategy.

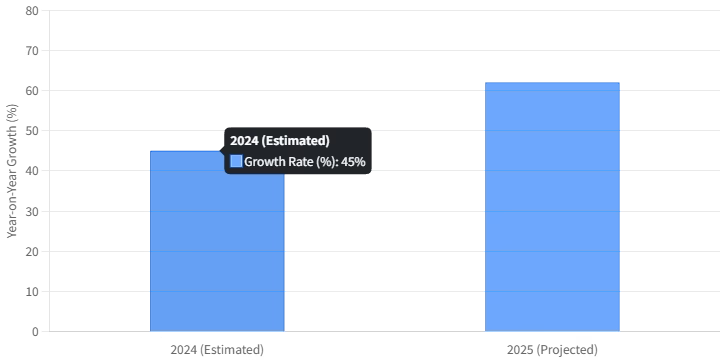

Some of Jiangsu’s most prominent industrial belts include Nanjing’s smart manufacturing and textiles, Suzhou’s smart home appliances and silk, Wuxi’s electric vehicles, and Nantong’s home textiles and fitness equipment. Each of these belts benefits from strong local supply chains, skilled labor pools, and often a history of export manufacturing. This foundation has enabled Jiangsu to quickly pivot and scale up its cross-border e-commerce capabilities. In fact, Jiangsu’s cross-border e-commerce imports and exports have grown by over 60% year-on-year in 2025, becoming a core growth engine for the province’s foreign trade. The province’s strategic focus on industrial belts has helped it avoid the trap of low-margin, commodity-style competition that often plagues traditional foreign trade. Instead, Jiangsu is leveraging its clusters to offer differentiated products and capture higher value in global markets.

Jiangsu Cross-Border E-Commerce Growth (2024-2025)

Key Advantages of Jiangsu’s Industrial Belts

Jiangsu’s industrial belts enjoy several competitive advantages that make them especially well-suited for cross-border e-commerce success. These advantages not only differentiate Jiangsu from other manufacturing regions but also provide a strong foundation for sustainable export growth. Below, we highlight the key strengths of Jiangsu’s industrial belts:

- Manufacturing Excellence and Scale: Jiangsu is a manufacturing powerhouse, with its industrial output accounting for about 1/8 of China’s total manufacturing value. This scale ensures that even niche industrial belts in the province are often significant in their own right. For example, Danyang in Jiangsu produces over 300 million pairs of eyeglasses annually, accounting for 40% of global production and 70% of the domestic market. Such dominance in a product category provides sellers with a reliable, high-quality supply base. It also means Jiangsu can offer comprehensive product lines within many categories – a boon for cross-border sellers looking to source a wide range of products from a single region. This breadth of supply is underpinned by the province’s deep industrial roots, which cover 31 of China’s 31 major manufacturing categories. Whether it’s mechanical equipment, textiles, electronics, or home goods, Jiangsu’s industrial belts have the expertise and capacity to produce at scale.

- Integrated Ecosystem of Commerce and Fintech: One of Jiangsu’s unique strengths is the seamless integration of e-commerce with financial services, exemplified by the success of its homegrown e-commerce platforms and fintech solutions. The rise of Mercado Livre – often called the “Amazon of Latin America” – is a notable success story. Founded in 1999, Mercado Livre has grown from an online marketplace into a full ecosystem that includes e-commerce, digital payments (Mercado Pago), logistics (Mercado Envios), and advertising. While not a Jiangsu company per se, its strategies and trajectory offer valuable lessons. Jiangsu’s industrial belts benefit from a similar closed-loop ecosystem. Many manufacturers in Jiangsu are supported by robust digital payment infrastructure (including local fintech solutions and the widespread Pix instant payment system in partner markets) and advanced logistics networks. This ecosystem integration creates a self-reinforcing cycle – as more manufacturers and sellers use the platform, it becomes more attractive to buyers, which in turn attracts more sellers, and so on. The result is a sticky customer base and a network effect that strengthens Jiangsu’s competitive position in the global e-commerce landscape. The presence of a unified ecosystem also helps reduce friction in cross-border transactions, from sourcing to payment to delivery, giving Jiangsu’s belts an edge in speed and reliability.

- Advanced Logistics and Supply Chain Innovation: A critical advantage of Jiangsu’s industrial belts is their access to world-class logistics and supply chain capabilities. The province is strategically located in the Yangtze River Delta, with Shanghai’s international port and numerous airports within close reach. Jiangsu has invested heavily in building out its own logistics infrastructure, including fulfillment centers, bonded warehouses, and dedicated cross-border e-commerce logistics parks. In fact, Jiangsu’s logistics network is often cited as a competitive moat that enables faster, more reliable deliveries than many of its peers. This is a significant differentiator in e-commerce, where delivery speed and cost can make or break a sale. Jiangsu’s logistics prowess is further enhanced by its participation in regional logistics initiatives like the Yangtze River Delta integration. For example, Jiangsu enterprises can leverage Shanghai’s port and the China-Europe Railway Express – a service that can move goods from Jiangsu to Europe in about 12 days at roughly 1/5 the cost of air freight and 2/3 the time of ocean freight. Such connectivity is a game-changer for industrial belts that need to reach global markets efficiently. Additionally, Jiangsu’s industrial belts are increasingly adopting supply chain innovation models like “digital flexible supply chains” and “modular (Lego-like) supply chains” to reduce costs and improve responsiveness. For instance, some home textile mills in Jiangsu have implemented smart production systems that reduce inventory to just 10-15% of turnover by producing to order. Others, like an auto parts cluster in Changzhou, have broken down their products into subcomponents that can be manufactured by different suppliers and then assembled, cutting costs by 30%. These innovations are direct responses to the challenges of cross-border trade (such as high logistics costs and the need for quick adaptation to market demands) and underscore the forward-thinking approach of Jiangsu’s industrial belts.

- Government Support and Policy Incentives: The development of Jiangsu’s industrial belts into cross-border e-commerce champions has been actively supported by government policy. Jiangsu’s authorities have recognized the strategic importance of the “industrial belt + cross-border e-commerce” model and have rolled out a series of initiatives to nurture it. In 2023, the Jiangsu provincial government, in collaboration with multiple departments, released the “Jiangsu Province Cross-Border E-Commerce High-Quality Development Action Plan (2023–2025)”, which set clear targets to bolster cross-border e-commerce. By 2025, Jiangsu aims to establish more than 30 cross-border e-commerce industrial belts, build over 120 cross-border e-commerce industrial parks, and cultivate 600 leading cross-border e-commerce enterprises with strong international competitiveness. The government also plans to support the development of over 100 public overseas warehouses and foster 100 export brands with significant international influence. These targets are not just aspirational; they are backed by concrete measures. Local governments across Jiangsu have been offering subsidies for international shipping routes, tax incentives, and logistical support to companies venturing into cross-border e-commerce. For example, some cities have introduced route subsidies to offset the high cost of air freight, effectively lowering the transportation expenses for sellers. There are also initiatives promoting “industrial belt + overseas warehouse” models, which combine local manufacturing with overseas warehousing to speed up deliveries and reduce costs. This policy support has created an enabling environment for industrial belts to thrive. It signals to businesses that the government is committed to facilitating their global expansion, which in turn encourages more investment and innovation in cross-border capabilities.

- Access to Global Markets and Platforms: Jiangsu’s industrial belts have aggressively embraced global e-commerce platforms to reach overseas consumers. Companies in the province are heavily reliant on platforms like Amazon, Alibaba International Station, Shopee, OTTO, and others to connect with buyers around the world. Nanjing, for instance, has over 5,000 foreign trade companies utilizing Amazon, Alibaba, and similar platforms to sell their products. This widespread adoption of international platforms is a deliberate strategy – it allows even smaller manufacturers in industrial belts to bypass traditional export middlemen and directly sell to end customers. The result is a democratization of global trade for Jiangsu’s manufacturers. Additionally, Jiangsu’s industrial belts are not just selling through existing platforms; some are also building their own direct-to-consumer channels. Successful brands like Estun (in industrial robots) and Ecovacs (in home robots) have transitioned from being primarily contract manufacturers to launching their own brands on global marketplaces. Estun, for example, expanded globally by leveraging its technology and building a network of 75 service outlets worldwide. Ecovacs, a leader in robotic vacuums, derived over 40% of its revenue from overseas markets in 2025, with its Tineco brand achieving 17.5% growth on Amazon. These case studies highlight how industrial belts in Jiangsu are moving up the value chain – from OEM manufacturing to brand owners – by capitalizing on the reach of global e-commerce platforms and the strength of their product offerings.

Cross-Border Ecosystem and Strategic Support

The success of Jiangsu’s industrial belts in cross-border e-commerce is not just about individual products or companies; it’s about the creation of a holistic cross-border e-commerce ecosystem. Jiangsu’s strategy has been to integrate its manufacturing prowess with digital tools, financial services, and policy support in a way that creates a self-sustaining loop of growth. This ecosystem approach is evident in several key areas:

- Digital Empowerment and Tech Integration: Technology is deeply embedded in Jiangsu’s cross-border e-commerce model. From artificial intelligence (AI) to big data analytics, industrial belts are leveraging tech to gain a competitive edge. One notable example is the use of AI to enhance compliance and risk management. In Wuxi, an “AI + International Law” platform has been developed to provide one-stop compliance services for cross-border businesses. This platform uses AI to help companies navigate complex international regulations, from customs documentation to product certification, reducing the risk of non-compliance and helping businesses operate more smoothly in foreign markets. On the operational side, many companies are adopting digital supply chain management systems. For instance, Niusai Network, a supply chain service provider, has introduced intelligent systems that connect demand signals directly with production lines, enabling a “produce-to-order” model that cuts down on inventory and waste. These digital tools are crucial in an industry where speed and efficiency are paramount. They also reflect Jiangsu’s broader push to become a leader in digital trade, which is a national priority as China seeks to upgrade its export model.

- Financial Services Integration: As touched upon earlier, the integration of financial services is a cornerstone of Jiangsu’s ecosystem. Mercado Pago, the financial arm of Mercado Livre, illustrates how a robust fintech platform can support cross-border commerce. In Latin America, Mercado Pago has grown to serve millions of users and process billions in payment volume, offering services like digital wallets, credit, and even a credit card that has become the most used on the platform. While Mercado Pago is not directly operating in Jiangsu, it represents the kind of fintech infrastructure that Jiangsu’s industrial belts are benefitting from domestically. In China, the rise of mobile payments and fintech solutions has made it easier for manufacturers and sellers to handle cross-border transactions, currency conversions, and even access working capital. Jiangsu’s manufacturers can use platforms like Alibaba’s Lianhua Pay or Tencent’s WeChat Pay for international transactions, reducing the friction of cross-border payments. Moreover, some industrial belts are experimenting with new financial models – for example, using supply chain financing to fund production based on overseas orders, thereby freeing up cash flow. The presence of these financial services means that companies in Jiangsu’s belts can focus more on innovation and production, rather than getting bogged down in the complexities of international finance.

- Policy and Infrastructure Synergy: The synergy between government policy and infrastructure development is another pillar of Jiangsu’s ecosystem. The Yangtze River Delta regional integration initiative is a case in point. This national strategy encourages cooperation between Shanghai, Jiangsu, Zhejiang, and Anhui to create a unified economic region. For Jiangsu, this means closer collaboration with Shanghai’s logistics hubs and financial markets, and with Zhejiang’s e-commerce expertise. Practical outcomes include streamlined customs procedures, shared infrastructure projects, and coordinated efforts to attract investment. On a more micro level, Jiangsu’s cities are establishing cross-border e-commerce industrial parks and incubators to support companies at every stage of growth. For example, Wuxi’s Xishan District has seen 302 companies join platforms like Amazon, with 18 electric vehicle firms contributing over two-thirds of the district’s cross-border export value. This clustering of similar businesses in parks fosters knowledge sharing, reduces service provider search costs, and can even lead to joint initiatives (like shared warehousing or marketing efforts). The government’s role in facilitating these clusters – through things like providing land, tax breaks, or even organizing training programs – has been instrumental in accelerating the growth of cross-border e-commerce across the province.

- Talent and Knowledge Development: A thriving ecosystem also requires a steady pipeline of talent and know-how. Jiangsu has been proactive in building this pipeline. Universities and vocational schools in the province have started offering specialized courses in cross-border e-commerce, digital marketing, and international trade. For instance, Changzhou has partnered with six universities to launch a pilot program that trains 800 students annually in new foreign trade formats, including cross-border e-commerce. Additionally, Wuxi’s Wujin District has established a digital culture college within its cross-border e-commerce industrial park, offering training in e-commerce design, operations, and live-streaming. These initiatives are helping to address a common bottleneck in the industry – the shortage of composite talents who understand both product development and digital marketing, or logistics and compliance. By cultivating local talent, Jiangsu ensures that its industrial belts have the human capital needed to sustain and scale their cross-border operations. It also creates a feedback loop: as more students are trained, the pool of skilled workers grows, which in turn attracts more companies to set up or expand their cross-border e-commerce activities in Jiangsu.

Case Studies: Success Stories from Jiangsu’s Industrial Belts

To illustrate the strengths and strategies of Jiangsu’s industrial belts, it is insightful to look at a few specific success stories. These case studies highlight how different belts have leveraged their unique advantages to achieve global success:

- Estun (Nanjing – Industrial Robots): Estun is a leading Chinese robotics company based in Nanjing, a key hub for Jiangsu’s smart manufacturing industrial belt. Estun’s journey from a traditional manufacturer to a global brand exemplifies the strategic evolution of Jiangsu’s industrial belts. Initially, Estun focused on producing industrial robots for the Chinese market. However, recognizing the potential of cross-border e-commerce, the company made a strategic shift. It invested in building its own brand and expanding its international presence. Estun acquired foreign robot brands to gain technology and market access, and it also developed its own proprietary products tailored to global needs. The result was a global matrix of brands and products that cater to diverse markets. Estun also leveraged Jiangsu’s logistics networks to set up 75 service outlets worldwide, ensuring after-sales support for its international customers. This approach – combining acquisitions, organic product development, and a strong service network – has allowed Estun to compete head-on with established global robotics firms. By 2025, Estun’s products were being used in factories around the world, and the company had become a flagship of China’s high-tech industrial belt going global.

- Yifante (Nantong – Women’s Sportswear): Yifante’s story is one of transformation from an original equipment manufacturer (OEM) to a successful direct-to-consumer brand. Yifante started out as a contract manufacturer for women’s sportswear, producing goods for other brands. However, the company saw an opportunity to create its own brand and sell directly to consumers overseas via platforms like Amazon and OTTO. This transition required a strategic overhaul. Yifante had to develop its own product lines, establish marketing capabilities, and build a brand identity – all while maintaining the flexibility of an OEM. The company responded by digitizing its supply chain and reconfiguring its production lines for flexibility. This digital transformation enabled Yifante to quickly adapt its production to new designs and customer feedback, a critical advantage in the fast-paced world of online retail. Yifante also focused on understanding overseas consumer preferences, tailoring its sportswear to fit Western tastes in fit, style, and performance. The results have been impressive. Yifante has grown from a small local manufacturer to a brand that is now recognized by fitness enthusiasts in North America and Europe. Its success underscores how Jiangsu’s industrial belts are moving up the value chain – from anonymous suppliers to brand owners – by embracing the cross-border e-commerce model.

- Ecovacs (Suzhou – Home Robotics): Ecovacs is a global leader in robotic vacuum cleaners and other home cleaning robots, and it is a prime example of a Jiangsu industrial belt company that has achieved international acclaim. Headquartered in Suzhou, Ecovacs has consistently been at the forefront of innovation in its field. The company’s product lineup includes robot vacuums, robot mops, and even air purifying robots, all designed to make home life easier. Ecovacs’ strength lies in its technology leadership and robust R&D capabilities, which are hallmarks of Suzhou’s smart manufacturing industrial belt. The company has invested heavily in AI and IoT technology to make its robots smarter and more user-friendly. This focus on innovation has paid off in the global market. By 2025, Ecovacs’ overseas business accounted for 40.8% of its total revenue, a clear indication that the majority of its growth was coming from outside China. One of Ecovacs’ notable achievements is the success of its Tineco brand on Amazon, which grew 17.5% in 2025. This growth is a testament to the brand’s popularity and the effectiveness of its e-commerce strategy. Ecovacs has also strategically expanded its distribution network, partnering with major retailers and e-commerce platforms in key markets. Its ability to deliver high-quality, innovative products directly to consumers’ homes has solidified its position as a market leader in home robotics. Ecovacs’ journey highlights the importance of Jiangsu’s industrial belts leveraging their tech strengths and brand-building capabilities to succeed in cross-border e-commerce.

- Danyang Eyewear (Zhenjiang – Optical Products): The Danyang optical industrial belt in Zhenjiang is a fascinating case of a niche product cluster achieving global dominance. Danyang produces a vast range of eyewear – from reading glasses to sunglasses – and has become known as the “eyewear capital of China.” In fact, one out of every two pairs of eyeglasses in the world is produced in Danyang, and the town’s output accounts for 40% of global production. This dominance is the result of decades of specialization and investment in the eyewear industry. Danyang’s manufacturers have developed complete supply chains for eyewear, from frame production to lens crafting and even eyewear case manufacturing. This end-to-end capability gives them significant control over quality and cost. In the cross-border e-commerce era, Danyang’s companies have aggressively tapped into global demand for affordable eyewear. They have leveraged platforms like Amazon, AliExpress, and even TikTok to reach consumers directly. A particular success story within Danyang is the rise of photochromic (color-changing) sunglasses. These sunglasses, which adjust their tint based on sunlight conditions, have become a hit in Europe and North America. Danyang’s manufacturers, recognizing this trend, have ramped up production of photochromic lenses and frames to meet overseas demand. The result has been a surge in exports of these high-tech sunglasses, further cementing Danyang’s reputation as an innovative and responsive supplier in the global eyewear market. This case illustrates how even a traditional industrial cluster can evolve and thrive by adapting to new market trends and utilizing the reach of e-commerce.

- Xishan Electric Vehicles (Wuxi – EVs and E-Bikes): Xishan District in Wuxi has emerged as a powerhouse for electric two-wheelers and related components. This industrial belt benefits from Wuxi’s broader strengths in advanced manufacturing and logistics. Companies in Xishan produce a wide range of products, from electric scooters and e-bikes to critical components like motors, batteries, and controllers. The cluster’s success in cross-border e-commerce is underscored by the fact that 18 electric vehicle firms in Xishan contribute over two-thirds of the district’s total cross-border export value. These companies have tapped into the global trend towards green transportation, exporting their products to markets in Southeast Asia, Europe, and beyond. One of the key strategies adopted by Xishan’s firms is to bundle sales of complete vehicles with spare parts and accessories, creating a one-stop solution for overseas buyers. This not only increases the average order value but also builds customer loyalty by providing a convenient package. Additionally, Xishan’s companies have been quick to adapt their products to local preferences in different markets – for example, offering e-bikes with higher battery capacity for countries with longer commutes or with enhanced safety features for markets with stricter regulations. The presence of a strong industrial base for electric vehicles in Xishan also means that companies can rapidly iterate and improve their products based on feedback from global markets. This agility, combined with the cluster’s scale, has made Wuxi’s Xishan District a model of how an industrial belt can capitalize on cross-border e-commerce to become a global supplier.

Challenges and Opportunities

While Jiangsu’s industrial belts have achieved remarkable success in cross-border e-commerce, they also face several challenges that must be navigated to sustain their growth. At the same time, these challenges present opportunities for innovation and further differentiation. Below, we outline some of the key challenges and opportunities on the horizon:

- Logistics and Cost Pressures: One of the most significant challenges for Jiangsu’s industrial belts is the high cost of logistics, particularly air freight. As an example, Nanjing’s Lukou International Airport handled 415,000 tons of cargo in 2024, compared to 2.38 million tons at Guangzhou’s airport. This stark difference highlights the capacity constraints and higher costs that Jiangsu’s exporters face when trying to move goods quickly. Air freight is often necessary for time-sensitive e-commerce shipments, but its expense can erode margins. The lack of sufficient direct long-haul flights from Jiangsu’s airports means many shipments must first transit through hubs like Shanghai or Guangzhou, adding time and cost. To address this, Jiangsu has been working to improve its logistics infrastructure – expanding airports, increasing cargo capacity, and even negotiating more direct international routes. However, these are long-term efforts. In the short term, companies in the industrial belts are finding creative solutions, such as optimizing packaging to reduce volumetric weight, consolidating shipments, or even exploring alternative transport modes (like rail or sea for less time-sensitive items). The challenge of logistics costs is also an opportunity for innovation in supply chain management. As mentioned earlier, some belts are adopting “modular supply chain” approaches to break products into smaller, shippable units and then reassemble overseas, which can significantly lower freight costs. Others are leveraging overseas warehouses more heavily – by pre-stocking goods in markets like the US or EU, companies can offer faster delivery times while saving on last-mile shipping costs. The pressure on logistics is thus driving Jiangsu’s belts to become even more efficient and inventive in their distribution strategies.

- Market Concentration and Diversification: A notable challenge for Jiangsu’s cross-border e-commerce is the heavy concentration of its export markets in Europe and the United States. According to analysis, up to 95% of the cross-border orders from Jiangsu’s industrial belts are destined for Western markets. While these markets are lucrative, this concentration exposes Jiangsu’s exporters to significant risks, such as changes in trade policies, economic downturns, or shifts in consumer preferences in those regions. For instance, an increase in tariffs or a slowdown in consumer spending in the US could have a disproportionate impact on Jiangsu’s export growth. Recognizing this, there is a push to diversify into emerging markets. Regions like Southeast Asia, the Middle East, and Latin America offer huge potential with growing middle classes and increasing internet penetration. Jiangsu’s industrial belts have started to tap into these markets – for example, some companies have begun selling on platforms like Shopee (Southeast Asia) or Mercado Livre (Latin America) to reach new customer bases. There are also initiatives to connect Jiangsu’s suppliers with buyers in the Middle East, as seen in trade fairs and digital matchmaking events. The challenge is that entering new markets often requires localizing products, marketing, and even logistics to suit local conditions. However, the opportunity is equally large – early movers into these markets can secure first-mover advantages and build brand recognition before competition heats up. Diversification will not only reduce risk but also open up new revenue streams, making Jiangsu’s industrial belts more resilient in the face of global market fluctuations.

- Talent and Skill Gaps: As touched upon earlier, the rapid growth of cross-border e-commerce has created a shortage of multidisciplinary talent. Companies in Jiangsu’s industrial belts are finding it challenging to recruit people who have a combination of technical knowledge (e.g., understanding of products and manufacturing) and digital skills (e.g., expertise in online marketing, data analytics, or international trade compliance). This talent gap can slow down innovation and expansion. For example, a manufacturer might have an excellent product but lack the know-how to effectively market it on Amazon or TikTok, or to navigate the legal requirements of selling in a new country. To address this, Jiangsu has been investing in education and training programs, as discussed. Additionally, many companies are turning to external service providers – consultants, agencies, or even AI-powered platforms – to fill the gaps in their capabilities. There is also a trend of upskilling existing employees. Manufacturers are training their engineers or sales staff in e-commerce operations, and conversely, e-commerce teams are learning about product features and manufacturing processes to improve communication with suppliers. The challenge of talent is thus driving a cultural shift within companies, fostering a more continuous learning environment. This, in turn, presents an opportunity for Jiangsu’s industrial belts to become more knowledge-intensive and less reliant on low-cost labor. By developing a workforce that is adept at both product development and digital commerce, these belts can sustain a competitive edge in an era where innovation and customer-centricity are key.

- Global Competition and Innovation: Jiangsu’s industrial belts are not operating in a vacuum. They face intense competition not just from other regions in China (like Guangdong or Zhejiang) but also from manufacturers around the world who are also leveraging e-commerce to reach global customers. Staying ahead requires continuous innovation. The challenge is to keep improving products, adopting new technologies, and finding new ways to delight customers. For instance, in categories like consumer electronics or home goods, competitors from other countries might undercut on price or rapidly copy successful products. Jiangsu’s belts must counter this with strong brand building, superior quality, and perhaps faster product iteration cycles. The rise of artificial intelligence in e-commerce – for things like personalized marketing, predictive demand forecasting, or even AI-designed products – presents both a challenge and an opportunity. Companies that can harness AI effectively will have a significant advantage, but those that lag may find themselves at a competitive disadvantage. Another area of competition is in the realm of customer experience and service. As e-commerce matures, customers increasingly expect not just the product at a low price, but a seamless buying experience, fast and free shipping, easy returns, and responsive customer service. Jiangsu’s industrial belts will need to continue to invest in improving these aspects to differentiate themselves. On the flip side, the need to innovate creates opportunities for collaboration within and between belts. For example, a smart home appliance manufacturer in Suzhou might partner with a textile manufacturer in Nantong to create a new kind of product (like a smart fabric) – such cross-pollination of ideas can lead to breakthrough innovations. Additionally, the global nature of e-commerce means that Jiangsu’s belts can learn from best practices around the world and adopt new business models quickly. Whether it’s subscription models, rental models for products, or integrating social commerce into their strategies, the opportunity to experiment and innovate is vast. The key is for Jiangsu’s industrial belts to remain agile and customer-focused, turning the pressure of competition into a catalyst for continuous improvement.

- Regulatory and Compliance Complexity: Selling globally means navigating a patchwork of regulations and standards – from product safety certifications to data privacy laws to customs requirements. For Jiangsu’s industrial belts, ensuring compliance in multiple markets can be a complex and costly endeavor. The challenge is exacerbated by the fact that regulations are constantly evolving (for example, new environmental standards or changes in tariff policies). A misstep can result in fines, goods being held at customs, or damage to a brand’s reputation. To manage this, companies are increasingly investing in compliance management systems and seeking expert advice. The Wuxi “AI + International Law” platform is one example of how technology is being used to simplify compliance. By using AI to keep track of regulatory changes and automate documentation, companies can reduce the risk of non-compliance. Another approach is to work with established cross-border e-commerce platforms that provide seller support in these areas. Platforms like Amazon or Alibaba often have teams that help sellers with things like getting products certified for different markets or understanding tax obligations. However, relying solely on platforms has its limits, especially as Jiangsu’s companies start building their own direct channels and selling via social media or marketplaces in emerging countries. Therefore, many are hiring compliance officers or partnering with legal firms to ensure they are on solid ground. The complexity of regulations also presents an opportunity for Jiangsu to develop service ecosystems around compliance. For instance, there could be growth in local testing labs, certification agencies, or legal consultancies that specialize in cross-border e-commerce. By proactively addressing compliance challenges, Jiangsu’s industrial belts can turn a potential barrier into a competitive advantage – being known for reliable, compliant products will enhance their reputation and trust with international buyers.

Conclusion

Jiangsu’s 30 industrial belts have undeniably become a driving force behind China’s cross-border e-commerce boom. Through a combination of manufacturing might, strategic innovation, and supportive policies, these belts have carved out a unique position in the global marketplace. They offer a rich variety of products – from high-tech robots to everyday home textiles – each backed by a deep well of expertise and a complete supply chain. The success of Jiangsu’s industrial belts is a testament to the province’s ability to adapt to the new realities of global trade, where e-commerce platforms and digital tools are as important as ports and shipping containers.

Looking ahead, the future is bright for Jiangsu’s industrial belts, but it will require continued focus on the core strengths that got them here: quality, innovation, and ecosystem thinking. There will be new challenges – be it from shifting geopolitical dynamics, emerging competitors, or changing consumer preferences – but the province’s industrial belts have shown they can evolve and thrive. The opportunities are equally vast, from further penetrating developing markets to pioneering new forms of global retail enabled by technologies like AI and 5G.

In conclusion, Jiangsu’s 30 industrial belts exemplify how a region can leverage its industrial heritage to become a powerhouse in the digital economy. They have moved beyond traditional manufacturing to become integral players in the global e-commerce value chain, creating brands, building direct customer relationships, and shaping the future of cross-border trade. As they continue to grow and innovate, Jiangsu’s industrial belts are poised to not only sustain their competitive edge but also set new benchmarks for what is possible in the world of cross-border e-commerce. For analysts, investors, and entrepreneurs looking at China’s export landscape, Jiangsu’s industrial belts offer a compelling case study of strategic industrial development meeting digital commerce – one that holds many lessons for the future of global trade.

Amazon Launches “Haul” to Sell Low-Priced Items to Compete with Temu, Shein

Below is a deeper look at what Haul is, how it works, why Amazon is…

Amazon Logistics Models: A Comprehensive Guide to FBA, FBM, and Third-Party Fulfillment

In the dynamic landscape of e-commerce, logistics plays a pivotal role in determining the success…

A Comprehensive Guide to Commercial Invoices (CI) in Cross-Border Logistics

Discover the essential elements of commercial invoices in cross-border logistics. Our comprehensive guide simplifies the…