what is cfr incoterm 2020? CFR Incoterm Cost and Freight Complete Guide, Understand cost and freight responsibilities with the latest insights for efficient global trade in 2024.

what is cfr incoterm 2020

CFR means the seller is responsible for clearing the goods for export, bringing them onboard the vessel, and paying for the transportation and other charges related to the delivery of goods until they reach the destination port.

Now, here there are two important things to consider:

- The transportation goods should be as per the buyers’ specification

- The transportation cost of the goods includes all costs incurred until they reach the destination port

What are Incoterms?

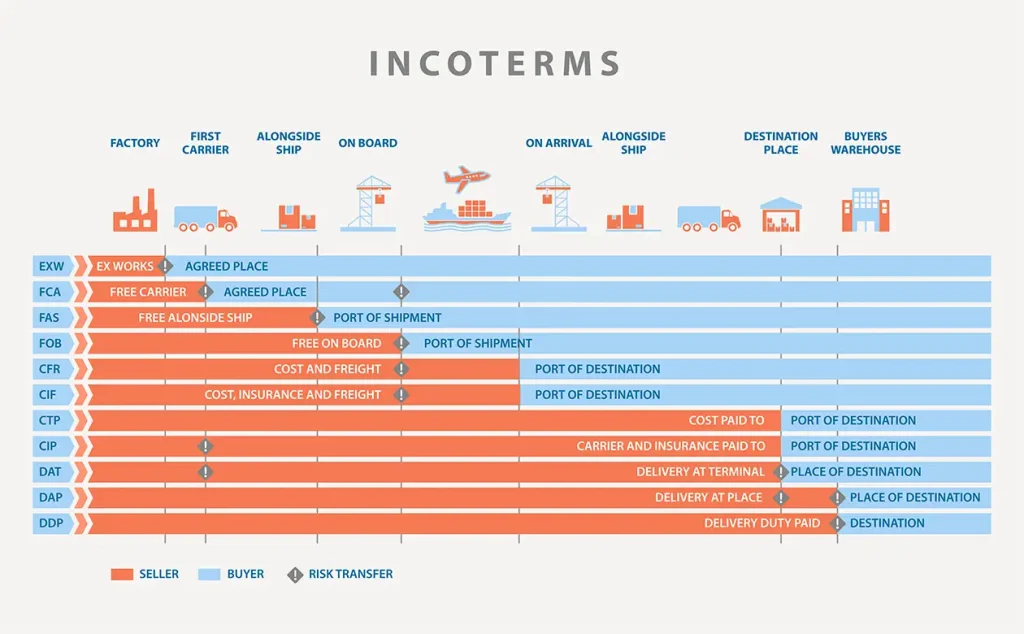

Short for International Commercial Terms, Incoterms are universally accepted and used rules by cargo transport operators and business communities to transport goods by land, air, or sea.

The ICC updates these terms every ten years, keeping the sea trade and transport system going smoothly.

There are seven Incoterm rules, of which four are specific to transporting goods over the sea.

These are:

FAS or Free Alongside Ship

FOB or Free on Board

CFR or Cost and Freight

CIF or Cost Insurance and Freight

So, how does CFR work?

As per common CFR practice and the Incoterms 2020 rules, the seller is obligated to place the goods on board the vessel. Thereon, the risk of loss or damage passes on to the buyer.

Components of Cost and Freight (CFR)

It’s important to understand that the seller’s responsibility ends when the goods are loaded onto the shipping vessel.

So they will pack the goods, clear them for export, transport them to the port, and load them. Thereafter, the buyer is responsible for unloading the goods, paying the duties or tariffs and taxes, and arranging and paying for the final transportation to their destination.

Also, under the Incoterms rules, the seller is not responsible for acquiring insurance for the goods to mitigate the risk of damage or loss during transit.

Now, an important aspect to understand is that the buyer and seller are responsible for two ports in CFR.

The seller delivers goods at the loading port and has to pay the freight to the destination port. Once the goods are loaded onto the vessel, the risk is transferred to the buyer, but the seller still covers the cost all the way to the destination port.

However, the buyer bears taxes, customs duties, and other such costs at the final port.

The buyer and seller are also free to decide which party will pay the unloading costs, but that must be specified in the contract.

Seller’s Responsibilities

As we discussed, per the CFR ruling, the seller must pay for all the costs incurred in transporting the goods from their origin to their destination port.

This means that the seller has to bear all the expenses, such as loading expenses, freight, the cost of any export procedures, etc., incurred by the shipment until it reaches the destination port.

The responsibilities of the seller can be delineated as follows:

- The seller must ensure timely and accurate delivery of goods with the commercial invoice and other necessary documentation.

- They must ensure the product is packaged and marked per the export requirements.

- The seller must handle all export licenses, pre-carriage and delivery, loading charges, and other customs formalities.

- They have to provide inland transportation in the country of origin.

- The seller has to handle the customs, fees, origin, and inland transportation charges in the country of origin.

- They also have to ensure delivery at the named port of destination.

- They have to bear the cost of pre-shipment inspection.

- Finally, they must deliver goods and documents and provide proof of delivery.

Buyer’s Responsibilities

Once the shipment reaches the destination port, the buyer is responsible for any costs incurred thereafter.

The buyer will pay for the unloading costs, transportation to the final destination, other duties, etc.

Here are the key responsibilities of the buyer:

- The buyer must accept the delivery of the goods when the seller delivers them on the vessel.

- They must ensure they receive the goods from the carrier at the destination port.

- They have to make payment for the goods as per the agreed terms.

- Upon delivery, the buyer will bear all risks of loss or damage.

- If the buyer fails to tell the seller about the destination point and the seller is unable to deliver the goods, the buyer will bear the risk of loss or damage to the goods.

- The choice of getting the goods insured is entirely up to the buyer; there’s no compulsion.

- The seller is obligated to conduct all export formalities per the country of export, including permits, customs fees payment, pre-shipment inspection, clearance, and other approvals/charges.

- They have to make payment for the discharge of goods and the carriage from thereon.

- The buyer will bear all other expenses, such as permits, licenses, import clearance, security clearance, other official approvals, etc., as they are incurred after delivery.

Pros and Cons of Using CFR Incoterms

Pros and Cons of Using CFR Incoterms

Although CFR clearly defines the roles and responsibilities of the buyer and seller, it has certain advantages and disadvantages. Let’s check them out.

Advantages for Sellers and Buyers

CFR streamlines the trade business and puts a fair responsibility on both the buyer and seller. It provides a price point that carries a particular advantage for the seller.

The seller is responsible for obtaining the carriage by chartering the vessel and paying the cost of the carriage. The cost of carriage is an input for the selling price, and the seller will build the CFR price with a profit margin while keeping a certain margin of error in it.

The seller may then have to pay for the freight before they acquire the bill of lading, but once the goods are on board the vessel, the risk of loss or damage to the cargo will no longer be their responsibility.

That means the seller has no risk beyond delivery.

Potential Drawbacks

Under CFR rules, the buyer is responsible for the risk of damage or loss of the shipment. Therefore, they may need to consider marine insurance on their own to mitigate the risk during transit.

Then there is another risk: if the buyer defaults, they won’t pay any deposit to the ship owner or arrange for the carriage.

In that case, the risk can be minimized by conducting due diligence on the buyer before entering into an agreement with them. The seller must check their credit rating, reputation, and past record.

Also, (at the seller’s end) prepare all shipping documents accurately. That means the bill of lading, packing list, commercial invoice, etc., should be ready so the trade goes smoothly without dispute.

CFR Vs. Other Incoterms

There are three other Incoterms, too, that are quite like CFR. Let’s take a look at each relative to CFR.

CFR Vs. FOB

In FOB (Free on Board), the seller has to load the goods onto the ship, but after that, the ownership is transferred to the buyer.

This means that all the costs and risks thereon have to be borne by the buyer. FOB is usually more applicable to containerized shipping.

CFR Vs. CIF

Both CFR and CIF are often used interchangeably. However, there’s a slight difference: in CIF, insurance is compulsory.

The seller must arrange to transport goods by sea to the destination port. Plus, the same seller has to provide insurance for the goods to the point they reach the destination port.

In CFR, the seller is not obligated to pay for insurance.

CFR Vs. CPT

In CPT (Carriage Paid To), the seller has to deliver the goods to the specified destination. That doesn’t have to be the port, but it could be a warehouse or other locations.

The seller also has to cover the transportation cost to this destination, insurance, and other customs duties or taxes.

However, their responsibilities end when the goods are delivered. Another difference between CFR and CPT is that while CFR is only used for sea routes, CPT can also be used for land, air, and railways.

CFR provides a clear ruling for both buyer and seller parties in terms of trade. With regulated international trade, we can ensure there are no delays or disputes, and the trade sector can be optimized for costs, risks, and responsibilities.

A Guide to China’s Top 5 Airports 2025

Soaring Through the Middle Kingdom: A Guide to China’s Top 5 Airports 2025, China’s meteoric…

The Ultimate Guide to Sourcing & Shipping Christmas Ornaments from China

The Ultimate Guide to Sourcing & Shipping Christmas Ornaments from China. The holiday season is…

Decoding Shunde: The Ultimate Guide to the World’s Appliance Capital

Decoding Shunde, If you’ve ever turned on a microwave, blended a smoothie, or adjusted your…